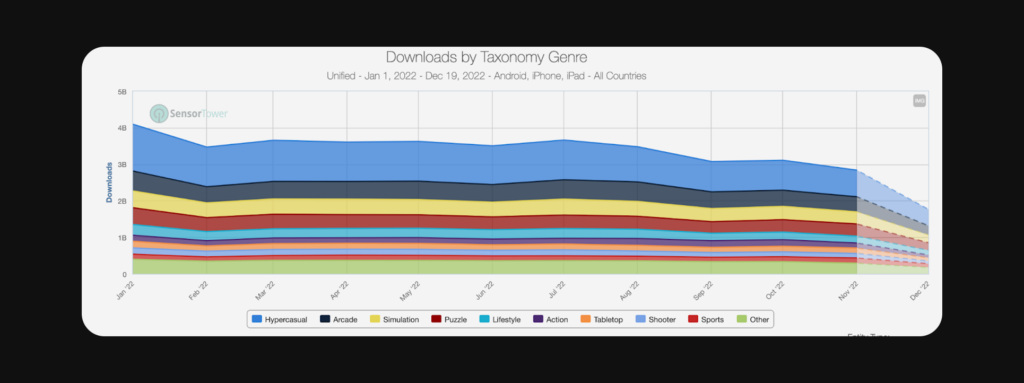

Recap ’22

2022 was a tricky year for the gaming industry. The year started with a decline across all game genres and the negative trend was there ever since. Hyper-casual segment felt much better, which gave optimism to teams and investors. Q2 was fruitful in both installs and revenue, however, mid-summer was a turning point. July’22 brought 1B hyper-casual installs and September showed only 830M, which is 40% less than in the beginning of the year, according to AppAnnie. The numbers should not discourage, though, here are some interesting thoughts to wrap-up the previous year and prepare for success in 2023.

Revenuzation of HC

The numbers indicate a quality-focused shift in the segment – fewer new projects, eCPM is lower, traffic acquisition has become more difficult, installs are decreasing, but revenue is stable. So, we make more money.

If broken down by advertising – installs are interstitial ads, revenue is in-app economy. In-app purchases are driven by an increasing number of deep gameplays, when the spending for players is justified and when hybrid monetization is propelling its way. That is the quality shift we’re talking about. “In the traditional economy today we would need to show 1,5 times more ads, which is not beneficial for players and which leads to outside-of-the-box solutions of changing the game, not taking the advantage of players. A year ago 600 sec of playtime would be nice, today if we have 600 sec after tests the only question is if we were to kill the project yesterday. That’s why developers focus on deepening the gameplay, boosting in-game metrics and moving towards hybrid monetization”, says Evgeniy Sidorov, CEO of FreePaly.

Prototypes and Hits ratio

In HC world the number of prototypes was constantly climbing since April 2020, reached the median of 3,000 a month in July 2021 and remains around this value since. However, the number of hits (red line) in 2022 is shockingly small, taking into account the fact that most downloads come from titles released in 2021.

In 2022 teams and publishers explored and experimented in order to find and secure the niche for themselves. “2023 will be transformative for the mobile gaming industry, teams will implement new strategies and approaches to boost performance and adapt to market needs”, adds Evgeniy Sidorov.

And A Few Thoughts From TheTaxonomy Standpoint

Puzzles

Puzzles are probably the last one where a small team can deliver outstanding results due to the high marketability threshold. A number of teams and publishers announced moves to the puzzles, but that won’t be a fast process.

Puzzles are different from other HC sub-genres – payback period might be up to 180 days plus iterations can have a crucial (yet delayed) effect on the funnel. For example, if in runner the developer can see a number of players leave the game at level 5, the fix is fast to come and the funnel is fast to improve. In puzzles, a tiny amendment to the complexity can drastically affect the tail and long-term metrics. Moreover, the setting’s and visual elements’ potential can bring its own challenge – they have to be easy to understand but versatile enough. In 2022 the genre was neither declining, nor growing. Let’s keep an eye on that.

Simulation

The overall decline in HC is attributed to simulation sub-genre fall. Simulations traditionally have low CPI and low retention and consequently are vulnerable to market fluctuations. If simulations don’t have high enough retention, it will make sense to merge them with/into other projects. We have seen nice examples of adding a goal and creating a metagame, as well as projects of mini-games.

Runners

Once the backbone of the HC segment, runners are now down by 50%. The sub-genre itself doesn’t allow much depth that leaves us with lower eCPM and median CPI at $0.20. The solution would be tireless experimentation – new settings that will surprise players. Just how we FreePlay did with Snake Run Race in December and made to the top of Google Play in the first week.

Action/Shooter

Action/shooter is a very nuanced genre. The expectations are set high from the console/PC games. HC action is relatively easy to develop, but difficult to monetize, which makes more sense for hybrid genres. A good thing though – there is always an audience for shooters.

Idle Clicker

Idle Clicker is the new hope for HC segment, but even the top titles secure not that many downloads (13-15M) despite all the buzz around it. This sub-genre is tricky – low CPI during tests can turn into extremely high CPI afterwards, not to mention the scalability problems.

Arcade Idle

Arcade Idle is one the few genres that actually continue to grow and the potential is far from being reached. One can say that these are casual games with hypercasual mechanics – true hybrid genre with lower entry bar than at midcore segment. It takes a while to master the Arcade game, most teams catch the wave around 3rd ot 4th project.